Is Spotify Stock a Buy or Sell? Evercore Is Long As Ark Sells SPOT

Spotify stock (NYSE: Place) has rallied by about seven per cent for the duration of the past five investing times but stays approximately 54 {5b4d37f3b561c14bd186647c61229400cd4722d6fb37730c64ddff077a6b66c6} beneath the for each-share selling price that it boasted at 2022’s starting. Now, as execs are forecasting podcasting profitability inside the future two decades, money gurus and traders are talking about SPOT’s path forward.

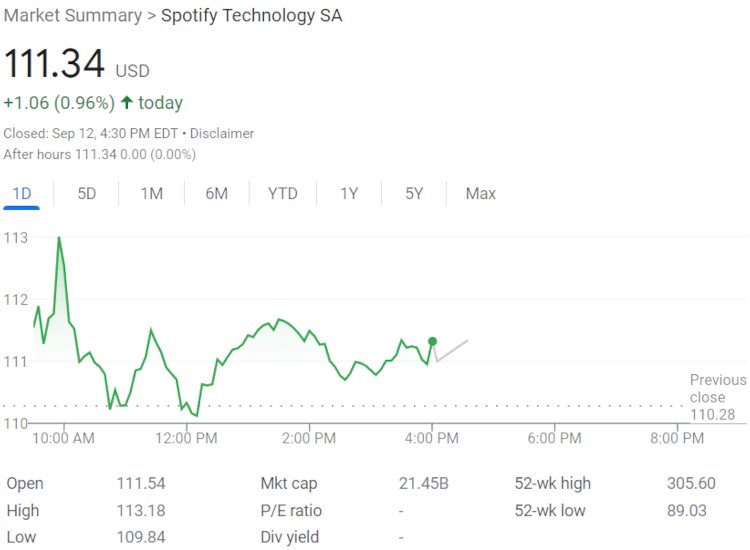

Through today’s trading several hours, Spotify inventory completed at $111.34 per share, representing an virtually one particular p.c enhancement from Friday’s shut as very well as the to begin with pointed out seven {5b4d37f3b561c14bd186647c61229400cd4722d6fb37730c64ddff077a6b66c6} attain throughout the latter 5 performing days.

But with Place hovering significantly beneath its 2022 high, the report rate of practically $400 that it touched towards 2021’s commence, and even its price at the time of Spotify’s 2018 IPO, some analysts are expressing the belief that the streaming giant’s inventory is very well-suited for lengthy-term investments.

A single these types of specific, Evercore senior handling director and head of internet analysis Mark Mahaney, touted SPOT’s perceived benefit in a the latest Closing Bell interview. Spotify CFO Paul Vogel previous 7 days participated in a half-hour dialogue at Evercore’s tech conference, for the duration of which he indicated that podcasting would become worthwhile for his organization in the course of the next 12 to 24 months.

“Spotify, I think, is an inflection-place story. I know that I mentioned that a year in the past, Sara, and it did not happen. … But heading into ’23, I believe you get gross margin growth for the 1st time ever for this identify, for a wide range of distinctive explanations,” Mahaney relayed of Spotify, which CEO Daniel Ek believes will make $100 billion yearly inside of the coming decade. “I assume they are ultimately achieving scale, I consider they are starting off to get a whole lot of marketing profits from artists and labels – that actually helps.

“And then they’re at last transferring off the large financial investment section that they’ve been placing into podcasting. All of that arrives together I believe beginning future year with gross margin expansion. And then they’ve had this user acceleration this 12 months that I believe can transform into paid out-sub acceleration upcoming year or strong progress future yr. I consider you want to be prolonged Spotify just before that happens, and which is now,” continued Mahaney.

When questioned about Spotify’s general performance outlook in a “recessionary atmosphere,” Mahaney explained tunes streaming platforms’ overarching subscription designs as “reasonably economic downturn resilient” – when also acknowledging a very likely falloff in phrases of advertising and marketing income.

“Unlike all people online video streaming expert services,” the former RBC controlling director spelled out, “people only indicator up for one particular tunes streaming assistance. Even in a difficult recession, you could slash your movie streaming offer from four to three to two movie streaming corporations, but you’re possibly going to keep that songs streaming bundle at 10 bucks a month.”

Notwithstanding this optimistic evaluation, Spotify stock’s current headlines have not been completely constructive.

Ark Commit founder and CEO Cathie Wooden, whose ETFs offloaded additional than $26 million truly worth of Spotify inventory in April by yourself, late very last week cashed out of one more 20,000 Location shares by way of an ETF, in accordance to stories.

Of course, time will reveal the functionality of Spotify inventory and the business alone, which by means of 2022’s preliminary eight and a person-50 {5b4d37f3b561c14bd186647c61229400cd4722d6fb37730c64ddff077a6b66c6} months has diversified into ticketing, audiobooks (tests will start out “very before long,” per CFO Paul Vogel), non-fungible tokens (NFTs), the metaverse, actual-time DJ sets, and a lot more.